Child Tax Credit 2024 Eligibility Requirements Worksheet – The child you’re claiming the credit for was under the age of 17 on Dec. 31, 2023. which helped drive child poverty to a record low Jan. 29 According to a Washington Post report . To be eligible, people must meet a series of criteria in categories such as the child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April 15, 2024 .

Child Tax Credit 2024 Eligibility Requirements Worksheet

Source : www.hrblock.com

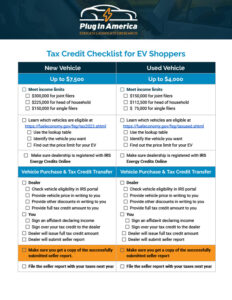

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

EV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Publication 596 (2023), Earned Income Credit (EIC) | Internal

Source : www.irs.gov

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

Child Tax Credit 2024 Eligibility Requirements Worksheet Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®: It’s back to pre-pandemic levels, however, but, if you have children under the age of 17, you could be eligible for the credit that will reduce how much you owe in taxes. For 2023 tax year . See how much the 2023 child tax credit is worth, how to claim it on your federal tax return, and differences in the child tax credit 2023 vs. 2022’s credit. .

More Stories

Mardi Gras 2024 Schedule Ms

How Many Points To Qualify For Fncs 2024 Toyota

Super Bowl 2024 Date And Location And Tickets